Car title loans (also referred to as title loans or auto title loans) are secured loans that use the borrower’s auto as collateral. If you deal with an emergency and also have poor credit score, title loans can assist.Look at a few of the best allotment loans for federal employees, with aggressive rates and lenient credit score necessities.A Lend

79 cash - An Overview

Overdraft fees may induce your account to generally be overdrawn by an sum that is greater than your overdraft coverage. A $15 cost may apply to each eligible order transaction that provides your account destructive. Balance have to be brought to at the very least $0 in just 24 hrs of authorization of the main transaction that overdraws your accoun

How december cash loan can Save You Time, Stress, and Money.

The bank aids borrowers preserve by giving an autopay lower price and charging no costs. Citigold or Citi Priority buyers can make the most of further reductions. Loan or hardship distribution from the 401(k) strategy: When you have a 401(k) by your task, you normally takes cash out of your respective retirement approach early through a 401(k) loa

About 89 cash

Any time you Check out your price to see what features you might qualify for, we conduct a delicate credit inquiry. It gained’t impact your credit history rating.So as to suit the higher-priced fighters on this card you will really have to punt with an underdog or two on this card. Montserrat is 1 of my most loved cash punts on your entire UF

Patrick Renna Then & Now!

Patrick Renna Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Bernadette Peters Then & Now!

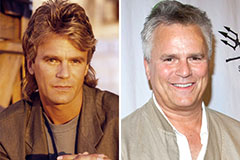

Bernadette Peters Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!